Texas has minimum auto insurance requirements. It’s important to purchase at least the amount required by law, but often this isn’t enough. We can help you determine the amount of coverage you need.

We offer free, online comparative quotes on Auto Insurance from multiple insurance carriers so you can get the best possible rates!

Your home and tangible assets need the protection of a homeowners insurance policy. These policies cover you in a home or an apartment, whether you are an owner or a renter. A well-written homeowners policy will pay to replace any of your personal property that is destroyed in a fire or other disaster. The policy will also be your first line of defense against a lawsuit from someone injured at your home.

If you live in a rented house or an apartment, renters insurance provides important coverage for both you and your possessions. In case your house or apartment is destroyed in a flood, or fire, or a friend is injured at your home, renters insurance provides financial protection for you and your family. It pays for the repair and replacement of lost items as well as any liability issues you may be responsible for.

Understand what you're buying to make sure it's right for you and your needs with plans that ensure that your loved ones will be taken care of. With pricing available for any budget, you will be able to decide how much coverage you want not how much you can afford.

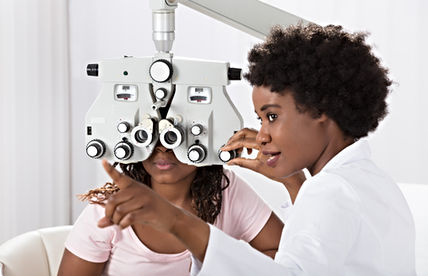

Your family's health is our top priority. We make it easy to get the best rates and coverage for your vision insurance. with insurance that provides coverage in the event of illness, accidents, and other healthcare necessities. Our plans offer low monthly premiums to cover you and your family's medical needs. Get the financial security and peace of mind you deserve for a fair price with individual, family, and over 65 health plans for your healthcare needs.

If you're looking for affordable dental and vision insurance, we're here to help. We offer the best rates with the most benefits as well as premium service.

Vision

Instant Quotes So You Can Visit The Doctor Tomorrow!

Your family's health is our top priority. We make it easy to get the best rates and coverage for your vision insurance.We offer the best rates with the most benefits as well as premium service.

Vision Instant Quotes So You Can Visit The Doctor Tomorrow!

Umbrella Insurance - Coverage options for personal Items, jewelry, fine art and more. Your possessions may be more valuable than you realize. Most homeowners policies offer limited coverage for personal articles such as jewelry, cameras, golf equipment, fine art and collectibles, and computer equipment.

We can provide the additional protection you need with a comprehensive valuable items insurance policy.

Commercial Umbrella • Protect your family's future with an umbrella policy that keeps your assets and cash flow intact with increased coverage for natural disasters and personal lawsuits and outside forces that could threaten your business financially.

As a business owner, we know how important it is for you to protect your investment. That’s why we are committed to providing our clients with the most comprehensive and suitable insurance policies to safeguard their businesses from a variety of risks. Whether it’s property damage, liability, or workers compensation, we have the expertise and resources to manage your insurance needs, leaving you free to focus on running your business

Commercial or business insurance is the perfect solution in providing protection for your company in case anything goes wrong.

Commercial insurance can provide a wide range of protection for your business. If written under a single policy, it will be an efficient means to combine all of the risks associated with operating with the liability available to protect your products or services rendered.

There are various types of commercial business insurance that meet your property, liability, and workers' compensation needs no matter what industry, our agency can design a protection program that's right for you!

-

Commercial Auto

-

Commercial Liability

-

Commercial Property

-

Commercial Flood & Fire

-

Group Health Plans

-

Contact Our Agency For the Best Rates Available!

The Premium Network Membership

Join the J. Randal Insurance Premium Network—your gateway to smarter coverage, retirement planning, and exclusive rewards. Learn, connect, and earn $10 with a no-obligation insurance review!

Access Educational GROUPS

FREE No-Obligation Insurance reviews

Access to contest and prizes from our agency

Enroll for Annual Reviews

Access to seminars and webinars on insurance and financial

SUBSCRIBE & Share Your Experience in Our Members Groups

Create an Account With J. Randal Insurance Agency Today

Gain easy access to insurance estimates, self-service options, personalized advice from our experienced team, and our new forum for industry professionals.

Our user-friendly platform is designed to simplify the insurance process and make it easier for you to get started. Plus, with our dedicated support team available around the clock, you can be sure that we're always here to help you find the right answers.

Advice From Expert Entrepreneurs!

Sign up Today!

The forum is a great place to connect with other business owners and professionals, share ideas, and get advice. It's also a great way to stay up-to-date on industry trends.

Crack the Investment Enigma: Expert Answers Await